Dogecoin (DOGE) has captured the attention of cryptocurrency enthusiasts and casual investors alike since its inception in December 2013. Initially created as a joke based on the popular “Doge” meme featuring a Shiba Inu dog, Dogecoin has evolved into a significant player in the cryptocurrency market. In this blog post, we will delve into the history, features, use cases, and future prospects of Dogecoin, providing a comprehensive analysis for both newcomers and seasoned investors.

History of Dogecoin

Dogecoin was created by software engineers Billy Markus and Jackson Palmer as a fun and lighthearted alternative to Bitcoin. The coin was launched on December 6, 2013, and quickly gained popularity due to its friendly community and charitable initiatives. In its early days, Dogecoin was often used for tipping content creators on social media platforms and for fundraising for various causes.

The coin’s inflationary model, which allows for an unlimited supply, was a departure from Bitcoin’s capped supply of 21 million coins. This feature has made Dogecoin an accessible option for microtransactions, further enhancing its use in tipping and online transactions.

Key Features of Dogecoin

1. Community-Driven

One of the standout features of Dogecoin is its vibrant and engaged community. The Dogecoin community has organized numerous charitable events, including raising funds for the Jamaican bobsled team to attend the 2014 Winter Olympics and sponsoring a NASCAR driver. The community’s spirit of generosity and fun has played a significant role in the coin’s popularity.

2. Low Transaction Fees

Dogecoin transactions are known for their low fees, making it an attractive option for users looking to send money quickly and affordably. This feature has contributed to its use in microtransactions and online tipping.

3. Fast Transaction Times

With an average block time of just one minute, Dogecoin transactions are confirmed quickly compared to many other cryptocurrencies. This speed enhances its usability for everyday transactions and online purchases.

4. Inflationary Supply Model

Unlike Bitcoin, which has a fixed supply, Dogecoin has no maximum supply limit. Currently, around 130 billion DOGE are in circulation, with approximately 5 billion new coins added each year. This inflationary model encourages spending rather than hoarding, aligning with Dogecoin’s original purpose as a currency.

Use Cases of Dogecoin

Dogecoin’s primary use cases include:

1. Tipping and Donations

Dogecoin is widely used for tipping content creators on platforms like Reddit and Twitter. Its low transaction fees and friendly community make it an ideal choice for small transactions.

2. Charitable Fundraising

The Dogecoin community has a strong tradition of supporting charitable causes. Numerous fundraising campaigns have been organized, leveraging the coin’s popularity to raise significant amounts for various initiatives.

3. Online Purchases

Some online retailers and service providers accept Dogecoin as a payment method, allowing users to make purchases with the cryptocurrency.

4. Trading and Investment

As the cryptocurrency market has matured, many investors have turned to Dogecoin as a speculative asset. Its price volatility can present opportunities for traders looking to capitalize on market movements.

The Role of Influencers and Media

Dogecoin’s popularity has been significantly influenced by social media and celebrity endorsements. High-profile figures like Elon Musk have frequently tweeted about Dogecoin, leading to surges in its price and mainstream attention. This media presence has helped Dogecoin transition from a niche cryptocurrency to a widely recognized digital asset.

Future Prospects of Dogecoin

While Dogecoin started as a meme, its future remains uncertain yet promising. The ongoing development of the cryptocurrency space and the potential for increased adoption in various sectors could enhance Dogecoin’s utility and value. However, investors should be cautious, as the volatility and speculative nature of cryptocurrencies can lead to significant price fluctuations.

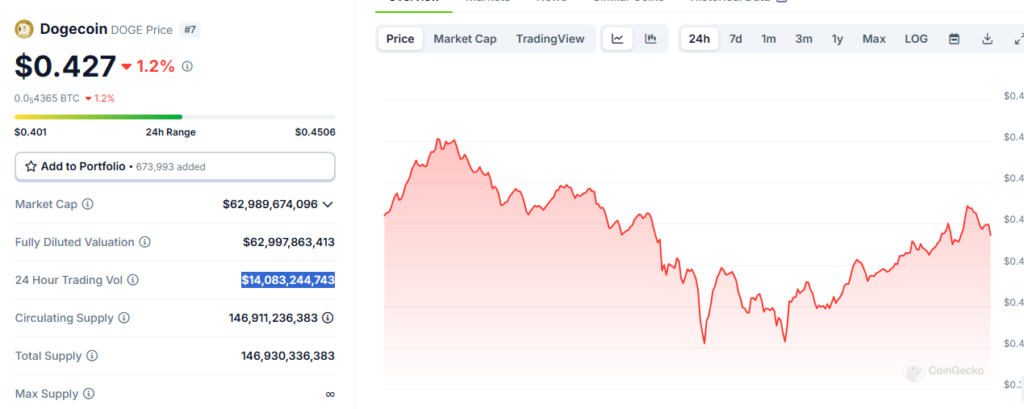

As of today, Dogecoin (DOGE) continues to be a notable player in the cryptocurrency market. Below is a detailed market analysis based on the current trends and data:

Current Market Overview

- Price Performance:

- As of the latest data, Dogecoin is trading at $0.427. This price reflects a 1.2% change over the past 24 hours, indicating a slight decrease.

- Over the past week, DOGE has shown a bullish trend, with fluctuations influenced by recent American elections where Elon Musk was appointed by Donald Trump as Head Of Department Of Government Efficiency (DOGE).

- Market Capitalization:

- Dogecoin’s market capitalization stands at around $62,989,674,096. This positions DOGE among the top cryptocurrencies, reflecting its substantial trading volume and investor interest.

- The coin remains one of the most recognized cryptocurrencies, often ranking in the top 10 by market cap.

- Trading Volume:

- The 24-hour trading volume for Dogecoin is approximately $14,083,244,743. This volume indicates active trading and interest from both retail and institutional investors.

- High trading volume can signal increased market activity and potential volatility, making it crucial for traders to stay informed.

- Market Sentiment:

- Sentiment analysis shows that Dogecoin is experiencing a mix of optimism and caution. Positive news, such as celebrity endorsements or increased adoption, can drive prices up, while negative news or regulatory concerns can lead to sell-offs.

- Social media sentiment remains strong, with discussions on platforms like Twitter and Reddit contributing to price movements.

Influencing Factors

- Market Trends:

- The overall cryptocurrency market is experiencing a bullish rally. Dogecoin often follows the trends of major cryptocurrencies like Bitcoin and Ethereum.

- Seasonal trends and historical performance during certain periods can also impact Dogecoin’s price.

- Regulatory Environment:

- Ongoing discussions about cryptocurrency regulations can affect market confidence. Any news regarding stricter regulations may lead to volatility across the crypto market, including Dogecoin.

- Technological Developments:

- Developments within the Dogecoin ecosystem, such as upgrades or new partnerships, can influence investor interest. Keeping an eye on community initiatives and technological advancements is essential for understanding future price movements.

As of today, Dogecoin remains a significant player in the cryptocurrency market with a dedicated community and a strong presence. While its price is influenced by broader market trends and sentiment, the unique characteristics of Dogecoin, such as its inflationary model and community-driven initiatives, continue to attract interest.

Investors should remain vigilant and conduct thorough research, considering both technical indicators and market sentiment before making investment decisions. As always, the cryptocurrency market is highly volatile, and past performance is not indicative of future results.

For the latest updates and detailed insights, continue monitoring market news and analysis on www.chaintech.africa

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Monero

Monero  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  Tokenize Xchange

Tokenize Xchange  Gate

Gate  USD1

USD1  Mantle

Mantle  VeChain

VeChain  Render

Render  Official Trump

Official Trump  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Cosmos Hub

Cosmos Hub  Lombard Staked BTC

Lombard Staked BTC  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Worldcoin

Worldcoin  Quant

Quant  Arbitrum

Arbitrum  Filecoin

Filecoin  Algorand

Algorand  Sky

Sky  Binance-Peg WETH

Binance-Peg WETH  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDtb

USDtb  USDT0

USDT0  Jupiter

Jupiter  KuCoin

KuCoin  Celestia

Celestia  Binance Staked SOL

Binance Staked SOL  NEXO

NEXO  Sonic

Sonic  Bonk

Bonk  Rocket Pool ETH

Rocket Pool ETH  Injective

Injective  Virtuals Protocol

Virtuals Protocol  Story

Story  SPX6900

SPX6900  Fartcoin

Fartcoin  Optimism

Optimism  Stacks

Stacks  Sei

Sei  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  PayPal USD

PayPal USD  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Immutable

Immutable  Solv Protocol BTC

Solv Protocol BTC  Maker

Maker  Mantle Staked Ether

Mantle Staked Ether  StakeWise Staked ETH

StakeWise Staked ETH  Wrapped BNB

Wrapped BNB  The Graph

The Graph  Curve DAO

Curve DAO  dogwifhat

dogwifhat  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  Tether Gold

Tether Gold  PAX Gold

PAX Gold  clBTC

clBTC  Zcash

Zcash  Jupiter Staked SOL

Jupiter Staked SOL  Theta Network

Theta Network  PancakeSwap

PancakeSwap  Marinade Staked SOL

Marinade Staked SOL  GALA

GALA  Lido DAO

Lido DAO  OUSG

OUSG  JasmyCoin

JasmyCoin  Ethereum Name Service

Ethereum Name Service  Walrus

Walrus  IOTA

IOTA  BitTorrent

BitTorrent  Pyth Network

Pyth Network  Stables Labs USDX

Stables Labs USDX  Pendle

Pendle  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  Usual USD

Usual USD  Kaia

Kaia  Raydium

Raydium  Solv Protocol Staked BTC

Solv Protocol Staked BTC  Jito

Jito  Polyhedra Network

Polyhedra Network  Core

Core  SyrupUSDC

SyrupUSDC  Pudgy Penguins

Pudgy Penguins  Grass

Grass  Tezos

Tezos  Ondo US Dollar Yield

Ondo US Dollar Yield  ApeCoin

ApeCoin  Falcon USD

Falcon USD  Flow

Flow  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  THORChain

THORChain  DeXe

DeXe  Super OETH

Super OETH  Helium

Helium  Saros

Saros  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Decentraland

Decentraland  Mantle Restaked ETH

Mantle Restaked ETH  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Wrapped HYPE

Wrapped HYPE  Onyxcoin

Onyxcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  TrueUSD

TrueUSD  Liquid Staked ETH

Liquid Staked ETH  tBTC

tBTC  Ket

Ket  Brett

Brett  Beldex

Beldex  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Kava

Kava  Aethir

Aethir  Bridged USDC (Polygon PoS Bridge)

Bridged USDC (Polygon PoS Bridge)  Starknet

Starknet  Dog (Bitcoin)

Dog (Bitcoin)  Eigenlayer

Eigenlayer  Maple Finance

Maple Finance  MultiversX

MultiversX  Aerodrome Finance

Aerodrome Finance  Keeta

Keeta  pumpBTC

pumpBTC  ether.fi Staked ETH

ether.fi Staked ETH  eCash

eCash  NEO

NEO  dYdX

dYdX  APENFT

APENFT  Compound

Compound  Circle USYC

Circle USYC  KAITO

KAITO  MimbleWimbleCoin

MimbleWimbleCoin  USDD

USDD  Arweave

Arweave  Telcoin

Telcoin  Conflux

Conflux  Reserve Rights

Reserve Rights  AIOZ Network

AIOZ Network  Staked HYPE

Staked HYPE  Axie Infinity

Axie Infinity  Zebec Network

Zebec Network  Ripple USD

Ripple USD  BUILDon

BUILDon