Chainlink has cemented its position as a key enabler of blockchain technology, bridging the gap between decentralised smart contracts and the real world. By providing reliable, verified external data, Chainlink’s oracle solutions have made it indispensable in decentralised finance (DeFi), insurance, and beyond. Its native token, LINK, consistently ranks among the top cryptocurrencies by market capitalisation.

Chainlink’s 2024 Prospects

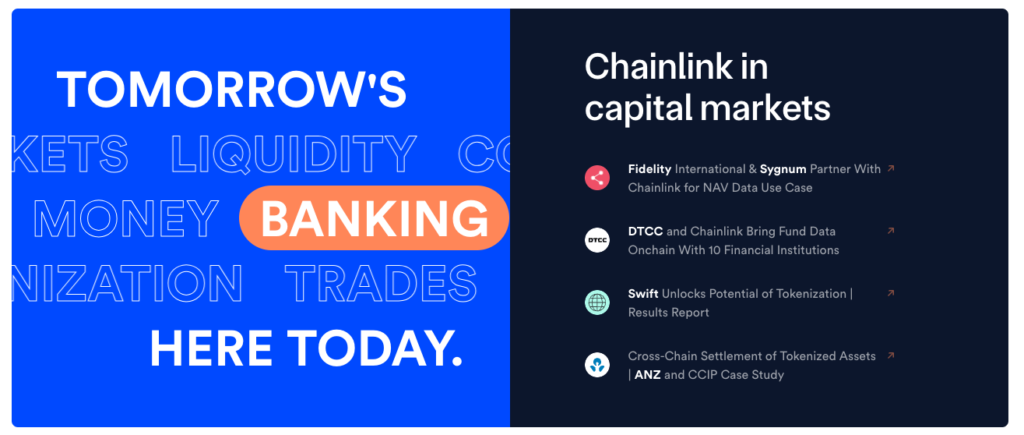

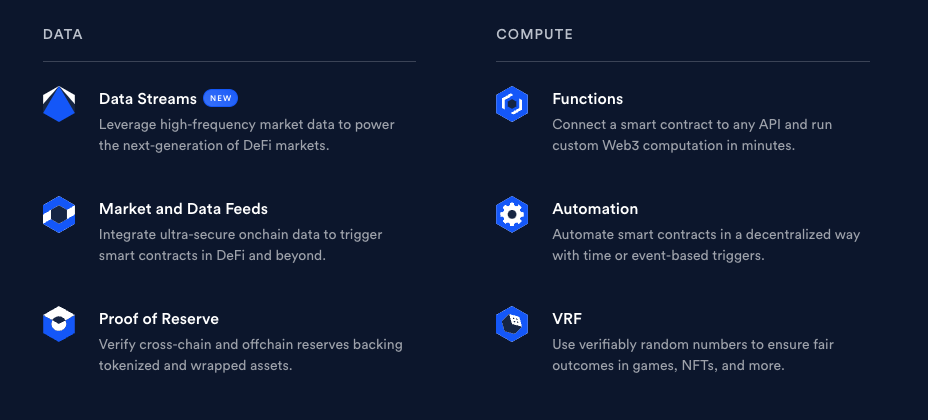

As 2024 draws to a close, Chainlink is at the forefront of innovation. Its focus on cross-chain capabilities through its Cross-Chain Interoperability Protocol (CCIP) and other advancements like Data Streams underscores its commitment to becoming the foundational infrastructure for tokenised assets. With financial heavyweights exploring its solutions, the project is poised to capture a slice of the projected $2 trillion tokenisation market.

This surge in adoption has placed LINK in a favourable position. Despite volatility, analysts predict LINK could reach $20 by the end of the year. The improving macroeconomic climate, including potential Federal Reserve rate cuts, may further bolster crypto market sentiment, driving interest in high-utility tokens like LINK.

Chainlink |LINK Price Prediction For 2025

In 2025, Chainlink’s role as the backbone of blockchain interoperability is expected to grow. Its oracle technology, which powers applications in Web3 gaming, metaverses, and AI-driven systems, is becoming increasingly integral. Analysts foresee LINK trading between $27.44 and $43.88 by the end of 2025, as institutional adoption and demand for cross-chain DeFi continue to rise.

The convergence of AI and blockchain, alongside the expansion of Web3 ecosystems, gives a massive growth opportunity for Chainlink. Its ability to connect disparate systems makes it an attractive option for businesses seeking seamless integration into blockchain networks.

Long-Term Vision: Chainlink |LINK Price Prediction For 2026 to 2030

Chainlink’s potential extends well beyond 2025. By 2030, its expanding use cases, particularly in sectors like decentralised insurance and supply chain transparency, could significantly drive LINK’s valuation. Decentralised insurance, for instance, relies on precise oracles to execute claims efficiently. Similarly, Chainlink’s role in verifying supply chain data addresses consumer demand for transparency and fraud prevention.

Price forecasts suggest LINK could reach an average of $360.57 by 2030, with the possibility of hitting highs of over $1,000. These projections are a sign to the growing importance of reliable oracle networks in blockchain ecosystem.

The LINK Token: The Engine Behind Chainlink

The LINK token is fundamental to Chainlink’s ecosystem. It incentivises accurate data reporting and facilitates transactions within the network. With a capped supply of 1 billion LINK tokens and approximately 608 million in circulation, scarcity combined with increasing demand could propel its value upward.

Challenges and Competitors

While Chainlink’s technology is robust, it faces competition from several emerging oracle solutions like the Pyth Network. The broader volatility of the crypto market also poses risks. However, Chainlink’s ongoing innovation and partnerships with industry giants provide it with a competitive edge.

Conclusion

Chainlink remains a cornerstone of blockchain innovation, with its oracle technology driving adoption across many industries. As its integration into real-world applications deepens, LINK’s growth trajectory looks to be promising for those considering long-term investments in cryptocurrency.

Investors, however, should remain mindful of market risks and exercise due diligence.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  Tokenize Xchange

Tokenize Xchange  Gate

Gate  USD1

USD1  Mantle

Mantle  VeChain

VeChain  Official Trump

Official Trump  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Cosmos Hub

Cosmos Hub  Lombard Staked BTC

Lombard Staked BTC  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Worldcoin

Worldcoin  Quant

Quant  Filecoin

Filecoin  Arbitrum

Arbitrum  Algorand

Algorand  Sky

Sky  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  USDT0

USDT0  KuCoin

KuCoin  Jupiter

Jupiter  Celestia

Celestia  Binance Staked SOL

Binance Staked SOL  NEXO

NEXO  Sonic

Sonic  Bonk

Bonk  Rocket Pool ETH

Rocket Pool ETH  Injective

Injective  Virtuals Protocol

Virtuals Protocol  Story

Story  Fartcoin

Fartcoin  SPX6900

SPX6900  Optimism

Optimism  Stacks

Stacks  Sei

Sei  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  PayPal USD

PayPal USD  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Solv Protocol BTC

Solv Protocol BTC  Immutable

Immutable  Maker

Maker  Mantle Staked Ether

Mantle Staked Ether  StakeWise Staked ETH

StakeWise Staked ETH  Wrapped BNB

Wrapped BNB  The Graph

The Graph  Curve DAO

Curve DAO  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  dogwifhat

dogwifhat  Renzo Restaked ETH

Renzo Restaked ETH  Tether Gold

Tether Gold  FLOKI

FLOKI  PAX Gold

PAX Gold  clBTC

clBTC  Jupiter Staked SOL

Jupiter Staked SOL  Zcash

Zcash  PancakeSwap

PancakeSwap  Theta Network

Theta Network  Marinade Staked SOL

Marinade Staked SOL  GALA

GALA  Lido DAO

Lido DAO  OUSG

OUSG  JasmyCoin

JasmyCoin  BitTorrent

BitTorrent  Stables Labs USDX

Stables Labs USDX  Ethereum Name Service

Ethereum Name Service  Walrus

Walrus  IOTA

IOTA  Pyth Network

Pyth Network  Pendle

Pendle  The Sandbox

The Sandbox  Bitcoin SV

Bitcoin SV  Usual USD

Usual USD  Raydium

Raydium  Solv Protocol Staked BTC

Solv Protocol Staked BTC  Polyhedra Network

Polyhedra Network  Kaia

Kaia  Core

Core  SyrupUSDC

SyrupUSDC  Jito

Jito  Pudgy Penguins

Pudgy Penguins  ApeCoin

ApeCoin  Grass

Grass  Tezos

Tezos  Ondo US Dollar Yield

Ondo US Dollar Yield  Falcon USD

Falcon USD  Flow

Flow  THORChain

THORChain  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  DeXe

DeXe  Helium

Helium  Super OETH

Super OETH  Saros

Saros  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Decentraland

Decentraland  Mantle Restaked ETH

Mantle Restaked ETH  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Onyxcoin

Onyxcoin  Wrapped HYPE

Wrapped HYPE  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  TrueUSD

TrueUSD  tBTC

tBTC  Liquid Staked ETH

Liquid Staked ETH  Ket

Ket  Brett

Brett  Beldex

Beldex  Kava

Kava  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Compound

Compound  Aethir

Aethir  Bridged USDC (Polygon PoS Bridge)

Bridged USDC (Polygon PoS Bridge)  Dog (Bitcoin)

Dog (Bitcoin)  Starknet

Starknet  Eigenlayer

Eigenlayer  Keeta

Keeta  MultiversX

MultiversX  pumpBTC

pumpBTC  eCash

eCash  Aerodrome Finance

Aerodrome Finance  KAITO

KAITO  dYdX

dYdX  NEO

NEO  Maple Finance

Maple Finance  Circle USYC

Circle USYC  APENFT

APENFT  ether.fi Staked ETH

ether.fi Staked ETH  MimbleWimbleCoin

MimbleWimbleCoin  USDD

USDD  Arweave

Arweave  Telcoin

Telcoin  Reserve Rights

Reserve Rights  AIOZ Network

AIOZ Network  Axie Infinity

Axie Infinity  Ripple USD

Ripple USD  Conflux

Conflux  BUILDon

BUILDon  Staked HYPE

Staked HYPE  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)