Bitcoin has consistently proven its resilience, and the next big milestone—£160K—might not be far off. Analysts from Matrixport attribute this bullish prediction to improving global macroeconomic conditions and a shift in monetary policies.

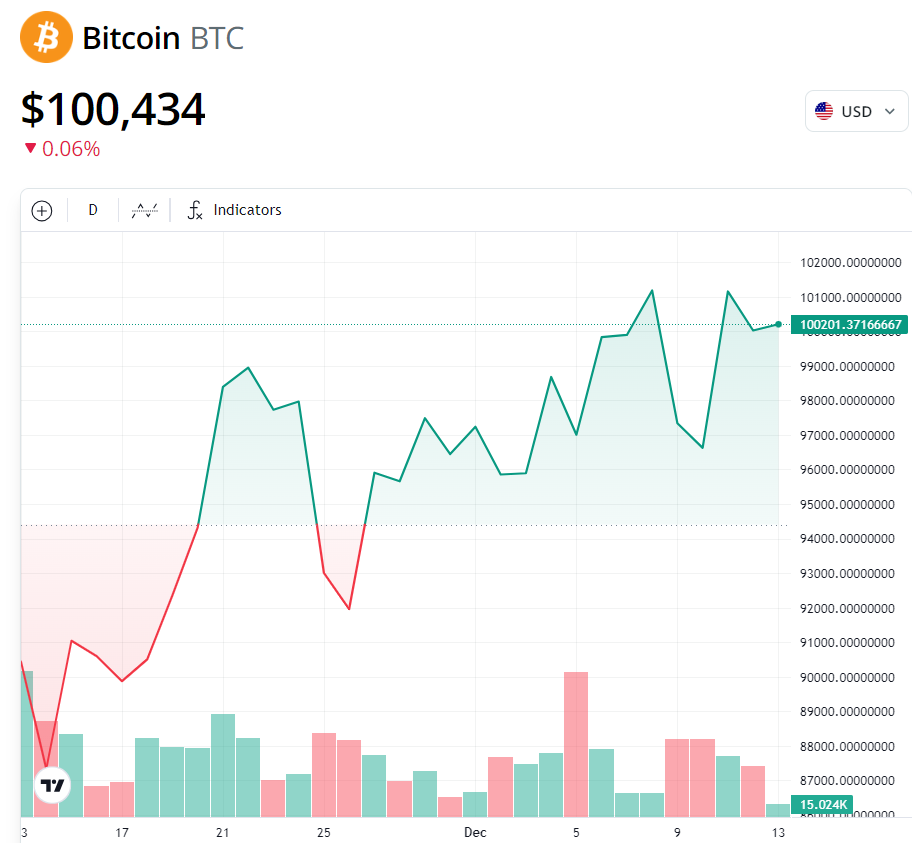

As Bitcoin recently crossed the £100K mark, this forecast shows the growing appeal of cryptocurrencies amidst evolving financial landscapes.

Central banks worldwide are easing monetary policies to stimulate economic growth. The European Central Bank (ECB) recently cut its key interest rate to 3%, while China lowered its one-year lending rate to 5.6%—its first reduction in over two years.

Jag Kooner of Bitfinex noted, “This dual easing could attract capital to risk-on markets, including cryptocurrencies, particularly during the optimistic December trading season.”

What This Means for Investors?

Lower interest rates reduce borrowing costs, prompting higher risk-taking. Bitcoin, often seen as a high-risk asset, stands to benefit as investors seek opportunities with greater potential returns.

A Path to £160K: What’s Driving It?

ETF Adoption: The growing demand for Bitcoin ETFs adds credibility and accessibility for institutional investors.

Market Liquidity: Expanding global liquidity pools are setting the stage for sustained growth.

Deleveraging: The recent £1.3 billion reduction in leveraged positions positions Bitcoin for its next rally.

Matrixport predicts Bitcoin could rise by 60%, citing these factors as key drivers for its £160K valuation by 2025.

With the Federal Reserve’s December decision looming, all eyes are on potential rate cuts. If implemented, Bitcoin could finish 2024 at record highs, creating momentum for an even brighter 2025.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Dai

Dai  MANTRA

MANTRA  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Filecoin

Filecoin  Ethena

Ethena  Algorand

Algorand  OKB

OKB  Fantom

Fantom  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  Optimism

Optimism  Ondo

Ondo  Bonk

Bonk  Celestia

Celestia  Immutable

Immutable  Theta Network

Theta Network  Movement

Movement  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Binance-Peg WETH

Binance-Peg WETH  Injective

Injective  The Graph

The Graph  dogwifhat

dogwifhat  Sei

Sei  Worldcoin

Worldcoin  THORChain

THORChain  Rocket Pool ETH

Rocket Pool ETH  Tokenize Xchange

Tokenize Xchange  Pudgy Penguins

Pudgy Penguins  Gate

Gate  FLOKI

FLOKI  JasmyCoin

JasmyCoin  Quant

Quant  Mantle Staked Ether

Mantle Staked Ether  Lido DAO

Lido DAO  Lombard Staked BTC

Lombard Staked BTC  GALA

GALA  Maker

Maker  Usual USD

Usual USD  Beam

Beam  The Sandbox

The Sandbox  KuCoin

KuCoin  NEXO

NEXO  Pyth Network

Pyth Network  Solv Protocol SolvBTC

Solv Protocol SolvBTC  Tezos

Tezos  Kaia

Kaia  Raydium

Raydium  Brett

Brett  Renzo Restaked ETH

Renzo Restaked ETH  Helium

Helium  Binance Staked SOL

Binance Staked SOL  Ethereum Name Service

Ethereum Name Service  Aerodrome Finance

Aerodrome Finance  Jupiter

Jupiter  Flow

Flow  AIOZ Network

AIOZ Network  Starknet

Starknet  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  Core

Core  Arweave

Arweave  IOTA

IOTA  Marinade Staked SOL

Marinade Staked SOL  dYdX

dYdX  Curve DAO

Curve DAO  NEO

NEO  Axie Infinity

Axie Infinity  MultiversX

MultiversX  Polygon

Polygon  Solv Protocol SolvBTC.BBN

Solv Protocol SolvBTC.BBN  Decentraland

Decentraland  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Zcash

Zcash  ether.fi Staked ETH

ether.fi Staked ETH  Pendle

Pendle  ApeCoin

ApeCoin  Jito

Jito  Eigenlayer

Eigenlayer  Mog Coin

Mog Coin  Akash Network

Akash Network  Chiliz

Chiliz  Fartcoin

Fartcoin  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  USDD

USDD  Conflux

Conflux  Wormhole

Wormhole  ai16z

ai16z  Mina Protocol

Mina Protocol  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Compound

Compound  Jupiter Staked SOL

Jupiter Staked SOL  Ronin

Ronin  PancakeSwap

PancakeSwap  Popcat

Popcat  SuperVerse

SuperVerse  Gnosis

Gnosis  eCash

eCash  Synthetix Network

Synthetix Network  Ether.fi Staked BTC

Ether.fi Staked BTC  SPX6900

SPX6900  Dog (Bitcon)

Dog (Bitcon)  Chia

Chia  Axelar

Axelar  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Tether Gold

Tether Gold  Notcoin

Notcoin  dYdX

dYdX  Amp

Amp  ZKsync

ZKsync  Mantle Restaked ETH

Mantle Restaked ETH  Grass

Grass  Peanut the Squirrel

Peanut the Squirrel  LayerZero

LayerZero  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Terra Luna Classic

Terra Luna Classic  Reserve Rights

Reserve Rights  CHEX Token

CHEX Token  Turbo

Turbo  Baby Doge Coin

Baby Doge Coin  Super OETH

Super OETH  sUSDS

sUSDS  Vana

Vana  ORDI

ORDI  cat in a dogs world

cat in a dogs world  Safe

Safe  Oasis

Oasis  Beldex

Beldex  Blur

Blur  1inch

1inch  Creditcoin

Creditcoin  PayPal USD

PayPal USD  Echelon Prime

Echelon Prime  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  DeXe

DeXe  PAX Gold

PAX Gold  APENFT

APENFT  pumpBTC

pumpBTC  Trust Wallet

Trust Wallet  Livepeer

Livepeer  TrueUSD

TrueUSD  Kusama

Kusama  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Nervos Network

Nervos Network  Arkham

Arkham