May 20, 2025 — Bitcoin has hit a bump just shy of its all-time high, triggering renewed debate over whether the world’s largest cryptocurrency is poised for another leg upward or preparing for a deeper pullback. While traditional chart patterns and short-term technical hint at potential turbulence, on-chain metrics tell a different story—one that may offer investors a reason for optimism.

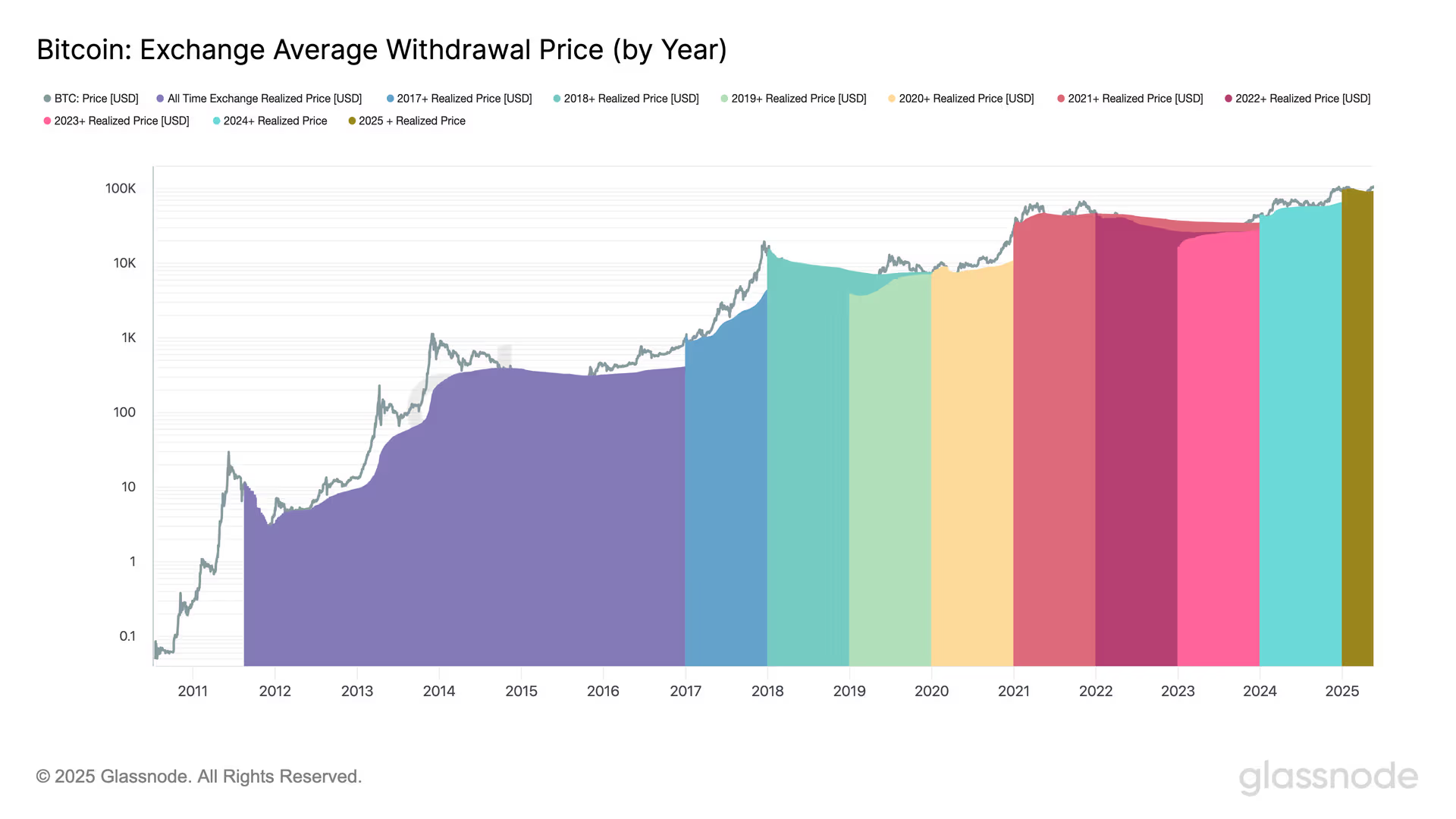

At the center of this bullish interpretation is the concept of Bitcoin’s “realized price,” an important on-chain indicator that reflects the average price at which all existing bitcoins last moved. Unlike market price, which reacts to sentiment and short-term volatility, realized price gives insight into the behavior of long-term holders and the underlying health of the network.

As of this week, Bitcoin’s realized price sits significantly below its current trading level—suggesting that a large majority of holders remain in profit. More importantly, historical data shows that when the market price remains well above the realized price for extended periods, it often signals the start of strong bull market conditions.

Current Market Snapshot

Bitcoin is currently trading around $68,500, down slightly from its recent attempt to breach the $70,000 level. This marks a hesitation just beneath the record high of approximately $73,800 set earlier this year. Analysts have attributed the pause to a mix of macroeconomic uncertainty, profit-taking, and cautious investor sentiment ahead of upcoming regulatory announcements in the U.S. and Europe.

Yet beneath the surface, network fundamentals remain robust. Hash rate, wallet activity, and long-term holder supply are all near historic highs. And most notably, the realized price—currently hovering near $24,500—continues to trend upward, reflecting increased conviction among holders who bought during previous bear markets and have yet to sell.

Realized Price as a Bull Market Signal

Historically, when Bitcoin’s market price exceeds the realized price by a significant margin for a sustained period, it tends to confirm the onset of a bullish cycle. This trend was evident in previous cycles, including the rallies in 2013, 2017, and 2021. In each case, a significant divergence between market and realized prices was accompanied by increased capital inflows, rising institutional interest, and growing retail engagement.

Today’s divergence is similarly notable. With the realized price more than 60% below current market levels, the data implies that the average investor remains in profit and is potentially less likely to sell during short-term dips. This dynamic reduces sell pressure and can help sustain bullish momentum.

Cautious Optimism Ahead

While Bitcoin may face headwinds in the short term—especially with regulatory and macroeconomic variables in play—the realized price metric offers a longer-term view that many investors find reassuring. Combined with increasing on-chain accumulation, low exchange balances, and rising interest from traditional financial institutions, there’s a growing sense that Bitcoin’s foundation is stronger than it appears during brief corrections.

Analysts urge caution, but also encourage investors to consider the broader on-chain picture. As Bitcoin consolidates near record highs, it’s the behavior of long-term holders and the strength of network fundamentals that could ultimately determine whether the next breakout is just around the corner.

Conclusion

Bitcoin’s inability to decisively break past its all-time high may appear discouraging on the surface, but deeper metrics like realized price point to enduring strength beneath the volatility. For seasoned crypto watchers, this divergence between price and fundamentals is not a warning—it’s an opportunity.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Ethena USDe

Ethena USDe  Stellar

Stellar  Figure Heloc

Figure Heloc  Avalanche

Avalanche  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDS

USDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Ethena

Ethena  Monero

Monero  Pepe

Pepe  Aave

Aave  Bitget Token

Bitget Token  Dai

Dai  OKB

OKB  MemeCore

MemeCore  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Ondo

Ondo  Ethereum Classic

Ethereum Classic  Worldcoin

Worldcoin  Aptos

Aptos  Story

Story  Pi Network

Pi Network  POL (ex-MATIC)

POL (ex-MATIC)  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  USDT0

USDT0  Binance-Peg WETH

Binance-Peg WETH  Internet Computer

Internet Computer  USD1

USD1  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Pudgy Penguins

Pudgy Penguins  Cosmos Hub

Cosmos Hub  Algorand

Algorand  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  VeChain

VeChain  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Gate

Gate  Sei

Sei  KuCoin

KuCoin  sUSDS

sUSDS  Bonk

Bonk  Official Trump

Official Trump  USDtb

USDtb  Filecoin

Filecoin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  StakeWise Staked ETH

StakeWise Staked ETH  Falcon USD

Falcon USD  Sky

Sky  BFUSD

BFUSD  Jupiter

Jupiter  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  Quant

Quant  Optimism

Optimism  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  Injective

Injective  Tether Gold

Tether Gold  Jupiter Staked SOL

Jupiter Staked SOL  PayPal USD

PayPal USD  SPX6900

SPX6900  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  NEXO

NEXO  Wrapped BNB

Wrapped BNB  Stacks

Stacks  Sonic

Sonic  Solv Protocol BTC

Solv Protocol BTC  Curve DAO

Curve DAO  Lido DAO

Lido DAO  Aerodrome Finance

Aerodrome Finance  syrupUSDC

syrupUSDC  Marinade Staked SOL

Marinade Staked SOL  The Graph

The Graph  PAX Gold

PAX Gold  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Super OETH

Super OETH  FLOKI

FLOKI  Four

Four  Pyth Network

Pyth Network  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  dogwifhat

dogwifhat  Kaia

Kaia  Raydium

Raydium  Conflux

Conflux  Saros

Saros  Fartcoin

Fartcoin  cgETH Hashkey Cloud

cgETH Hashkey Cloud  PancakeSwap

PancakeSwap  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  Pendle

Pendle  Theta Network

Theta Network  Tezos

Tezos  GALA

GALA  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Zcash

Zcash  Ethereum Name Service

Ethereum Name Service  IOTA

IOTA  The Sandbox

The Sandbox  Jito

Jito  Binance-Peg Dogecoin

Binance-Peg Dogecoin  JasmyCoin

JasmyCoin  Ripple USD

Ripple USD  OUSG

OUSG  Decentraland

Decentraland  Stader ETHx

Stader ETHx  Ether.fi

Ether.fi  ether.fi Staked ETH

ether.fi Staked ETH  Flow

Flow  tBTC

tBTC  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Aethir

Aethir  AB

AB  BitTorrent

BitTorrent  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Walrus

Walrus  Mantle Restaked ETH

Mantle Restaked ETH  Swell Ethereum

Swell Ethereum  Beldex

Beldex  Global Dollar

Global Dollar  Loaded Lions

Loaded Lions  Usual USD

Usual USD  Starknet

Starknet  EigenCloud (prev. EigenLayer)

EigenCloud (prev. EigenLayer)  Brett

Brett  Vision

Vision  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  BUILDon

BUILDon  dYdX

dYdX  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Bybit Staked SOL

Bybit Staked SOL  ApeCoin

ApeCoin  TrueUSD

TrueUSD  USDD

USDD  Arweave

Arweave  Telcoin

Telcoin  Helium

Helium  NEO

NEO  Fluid

Fluid  Reserve Rights

Reserve Rights  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Core

Core  Keeta

Keeta  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  THORChain

THORChain