May 30, 2025

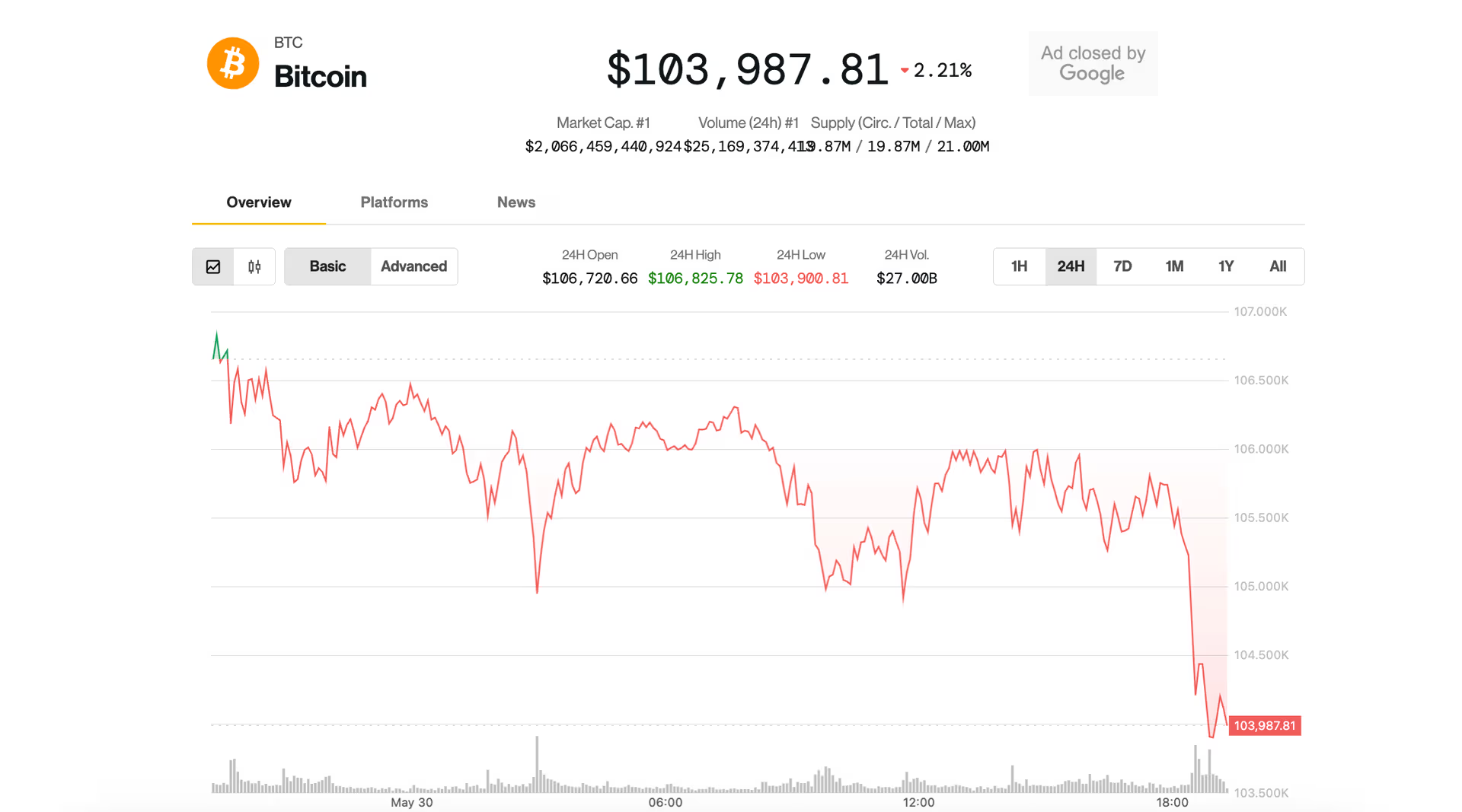

The cryptocurrency market took a sharp downturn today as Bitcoin fell below the $104,000 mark, weighed down by renewed geopolitical tensions between the United States and China. The broader digital asset market mirrored the decline, with major altcoins including Ethereum, Solana, and XRP also posting losses in the wake of escalating tariff threats.

Bitcoin, which had been trading in a relatively narrow range above $106,000 earlier this week, dropped more than 4% in the past 24 hours, touching lows of $103,500 before slightly recovering. The decline coincided with reports of Washington imposing new tariffs on Chinese semiconductor and electric vehicle imports, a move Beijing swiftly condemned with promises of retaliatory measures.

Tariffs Reignite Investor Anxiety

The re-emergence of trade tensions between the world’s two largest economies has stoked investor fears, not only in traditional financial markets but across risk-sensitive sectors, including crypto. Analysts say the market reaction highlights the current fragility in investor sentiment, particularly in an environment of global economic uncertainty and tightening liquidity.

“Crypto has become increasingly sensitive to macroeconomic and geopolitical developments,” said Elena Wu, Head of Research at ChainSight Analytics. “While some still see it as a hedge, the asset class now reacts much like tech stocks when global uncertainty flares up.”

Altcoins Under Pressure

Ethereum (ETH) followed Bitcoin’s lead, falling below the $5,600 threshold, marking a 3.7% daily decline. Solana (SOL), which had shown relative strength recently, slumped by over 5% to trade around $168. XRP and Cardano (ADA) also saw losses ranging from 3% to 6%.

Even newer entrants like Toncoin and Aptos, which had seen speculative rallies in recent weeks, were not immune to the broad market sell-off.

Market Outlook Remains Cautious

Crypto traders and analysts are now closely watching for further developments in the U.S.-China trade dispute, as well as any commentary from the Federal Reserve that might provide clues on interest rate policy heading into the second half of the year.

“The next few days could be highly volatile,” said Julian Nader, a crypto strategist at Luma Markets. “If tensions worsen, risk assets including crypto could see deeper pullbacks. But any signs of de-escalation might trigger a quick rebound.”

Despite the sell-off, some long-term investors see the correction as a potential buying opportunity, particularly given Bitcoin’s strong performance year-to-date — it’s still up over 40% since January, even after today’s dip.

As markets await more clarity on the geopolitical front, the message is clear: macro risks continue to cast a long shadow over even the most decentralized assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Ethena USDe

Ethena USDe  Stellar

Stellar  Figure Heloc

Figure Heloc  Avalanche

Avalanche  Wrapped eETH

Wrapped eETH  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDS

USDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  Mantle

Mantle  Ethena

Ethena  Monero

Monero  Pepe

Pepe  Aave

Aave  Bitget Token

Bitget Token  Dai

Dai  OKB

OKB  MemeCore

MemeCore  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Ondo

Ondo  Ethereum Classic

Ethereum Classic  Worldcoin

Worldcoin  Aptos

Aptos  Story

Story  POL (ex-MATIC)

POL (ex-MATIC)  Pi Network

Pi Network  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  USDT0

USDT0  Binance-Peg WETH

Binance-Peg WETH  Internet Computer

Internet Computer  USD1

USD1  Pump.fun

Pump.fun  Pudgy Penguins

Pudgy Penguins  Cosmos Hub

Cosmos Hub  MYX Finance

MYX Finance  Algorand

Algorand  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Kinetiq Staked HYPE

Kinetiq Staked HYPE  VeChain

VeChain  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Gate

Gate  Sei

Sei  KuCoin

KuCoin  sUSDS

sUSDS  Bonk

Bonk  Official Trump

Official Trump  USDtb

USDtb  Filecoin

Filecoin  Sky

Sky  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  StakeWise Staked ETH

StakeWise Staked ETH  Falcon USD

Falcon USD  BFUSD

BFUSD  Jupiter

Jupiter  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  Quant

Quant  Optimism

Optimism  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  Injective

Injective  Tether Gold

Tether Gold  Jupiter Staked SOL

Jupiter Staked SOL  PayPal USD

PayPal USD  SPX6900

SPX6900  Mantle Staked Ether

Mantle Staked Ether  NEXO

NEXO  Immutable

Immutable  Wrapped BNB

Wrapped BNB  Stacks

Stacks  Sonic

Sonic  Solv Protocol BTC

Solv Protocol BTC  Curve DAO

Curve DAO  Lido DAO

Lido DAO  Aerodrome Finance

Aerodrome Finance  syrupUSDC

syrupUSDC  Marinade Staked SOL

Marinade Staked SOL  The Graph

The Graph  PAX Gold

PAX Gold  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Super OETH

Super OETH  FLOKI

FLOKI  Four

Four  Pyth Network

Pyth Network  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  dogwifhat

dogwifhat  Kaia

Kaia  Raydium

Raydium  Conflux

Conflux  Saros

Saros  Fartcoin

Fartcoin  cgETH Hashkey Cloud

cgETH Hashkey Cloud  PancakeSwap

PancakeSwap  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  Pendle

Pendle  Theta Network

Theta Network  Tezos

Tezos  GALA

GALA  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Zcash

Zcash  Ethereum Name Service

Ethereum Name Service  IOTA

IOTA  The Sandbox

The Sandbox  Jito

Jito  Binance-Peg Dogecoin

Binance-Peg Dogecoin  JasmyCoin

JasmyCoin  Ripple USD

Ripple USD  Decentraland

Decentraland  OUSG

OUSG  Stader ETHx

Stader ETHx  Ether.fi

Ether.fi  ether.fi Staked ETH

ether.fi Staked ETH  Flow

Flow  tBTC

tBTC  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Aethir

Aethir  AB

AB  BitTorrent

BitTorrent  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Walrus

Walrus  Mantle Restaked ETH

Mantle Restaked ETH  Swell Ethereum

Swell Ethereum  Beldex

Beldex  Global Dollar

Global Dollar  Loaded Lions

Loaded Lions  Usual USD

Usual USD  Starknet

Starknet  EigenCloud (prev. EigenLayer)

EigenCloud (prev. EigenLayer)  Brett

Brett  Vision

Vision  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  BUILDon

BUILDon  dYdX

dYdX  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  Bybit Staked SOL

Bybit Staked SOL  ApeCoin

ApeCoin  TrueUSD

TrueUSD  Telcoin

Telcoin  USDD

USDD  Arweave

Arweave  Helium

Helium  NEO

NEO  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Fluid

Fluid  Reserve Rights

Reserve Rights  Core

Core  Keeta

Keeta  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  THORChain

THORChain