June 17, 2025

By Precious A.

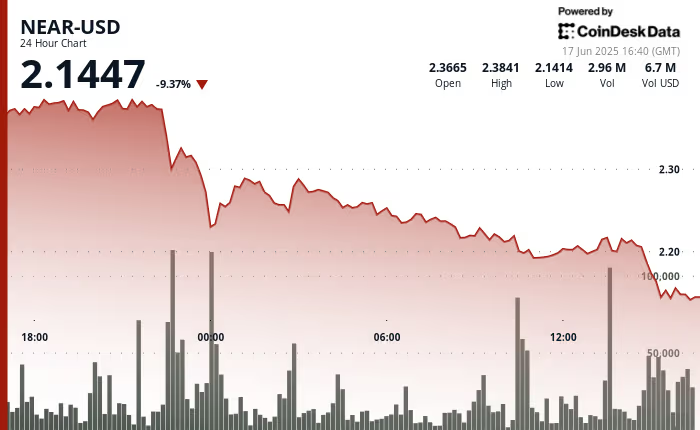

The NEAR Protocol token (NEAR) fell sharply on Monday, dropping more than 8% in 24 hours, as rising geopolitical tensions in the Middle East sent shockwaves across global risk assets — including the cryptocurrency market.

Geopolitical Jitters Trigger Broad Sell-Off

The sharp drop in NEAR’s price comes amid escalating conflict between regional powers in the Middle East, with new reports of drone strikes, retaliatory air raids, and concerns about potential disruptions to oil supplies. Investors across asset classes are reacting with caution, rotating out of riskier positions and into safe havens like gold and the U.S. dollar.

While the broader crypto market experienced a modest pullback — with Bitcoin down 2.3% and Ethereum off by 2.8% — NEAR was among the hardest-hit major altcoins, losing over 8% on the day and erasing nearly two weeks of gains.

“NEAR’s volatility can be partly attributed to its relatively lower liquidity and its high concentration among speculative DeFi investors,” noted Clara Zhou, Senior Market Analyst at ChainSignal Research. “When risk-off sentiment hits, altcoins with more aggressive growth narratives tend to suffer the most.”

Why NEAR Was Hit Harder Than Others

The NEAR ecosystem has seen rapid growth over the past year, particularly in DeFi and AI-focused decentralized applications. However, this rapid expansion has also made it more vulnerable to macro shocks.

In recent weeks, NEAR saw increased inflows as traders bet on its AI and zero-knowledge (ZK) roadmap, pushing it to yearly highs. But analysts suggest that much of that momentum was built on speculative positioning, which unwound quickly as geopolitical risk re-entered the global market narrative.

Whale Movements and Technical Breakdowns

According to on-chain data from Arkham Intelligence, several large NEAR wallets moved tokens to centralized exchanges over the weekend, a common precursor to sell-offs. Technical traders also flagged that NEAR broke below key support levels at $6.10, triggering stop-loss orders and accelerating the decline.

“This is a classic flush-out,” said Mike Tully, a crypto derivatives trader based in Chicago. “The fundamentals of the NEAR ecosystem haven’t changed, but when macro pressure rises, people cut their most volatile bets first.”

Wider Crypto Market Feels the Heat

The NEAR sell-off occurred within a broader context of unease across digital assets. Altcoins like Solana (SOL), Avalanche (AVAX), and Chainlink (LINK) also saw single-digit percentage losses, while total crypto market capitalization fell by nearly $50 billion on the day.

Bitcoin, the market’s bellwether, remained relatively resilient, holding above the $66,000 level despite increased volatility.

Outlook: Temporary Setback or Deeper Correction?

While it’s unclear how long the geopolitical tensions will persist, market participants remain cautious. Some analysts see the dip as a buying opportunity, particularly for investors with long-term conviction in NEAR’s technology and developer traction.

“Short-term fear is obscuring long-term value,” argued Dr. Elias Farid, a blockchain researcher at the University of Toronto. “NEAR continues to be one of the most developer-friendly, scalable chains in the space, and its ecosystem growth remains impressive despite macro headwinds.”

Conclusion

NEAR’s sharp plunge underscores the crypto market’s vulnerability to macroeconomic and geopolitical shocks. While the protocol’s fundamentals remain intact, risk-off sentiment is dominating the narrative in the short term. Investors may need to brace for continued volatility as global tensions unfold — but for those with longer time horizons, current prices may present a strategic opportunity.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  Sui

Sui  Avalanche

Avalanche  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Toncoin

Toncoin  Cronos

Cronos  Shiba Inu

Shiba Inu  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Mantle

Mantle  Monero

Monero  Ethena

Ethena  Pepe

Pepe  Aave

Aave  Bitget Token

Bitget Token  Dai

Dai  OKB

OKB  MemeCore

MemeCore  Jito Staked SOL

Jito Staked SOL  Worldcoin

Worldcoin  NEAR Protocol

NEAR Protocol  Bittensor

Bittensor  Ondo

Ondo  Ethereum Classic

Ethereum Classic  Aptos

Aptos  Story

Story  Pi Network

Pi Network  Binance Staked SOL

Binance Staked SOL  POL (ex-MATIC)

POL (ex-MATIC)  Pump.fun

Pump.fun  USDT0

USDT0  Arbitrum

Arbitrum  Binance-Peg WETH

Binance-Peg WETH  Internet Computer

Internet Computer  USD1

USD1  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Pudgy Penguins

Pudgy Penguins  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Algorand

Algorand  Kinetiq Staked HYPE

Kinetiq Staked HYPE  VeChain

VeChain  MYX Finance

MYX Finance  Rocket Pool ETH

Rocket Pool ETH  sUSDS

sUSDS  Render

Render  Gate

Gate  KuCoin

KuCoin  Sei

Sei  Bonk

Bonk  Sky

Sky  USDtb

USDtb  Official Trump

Official Trump  Filecoin

Filecoin  Falcon USD

Falcon USD  StakeWise Staked ETH

StakeWise Staked ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Jupiter

Jupiter  BFUSD

BFUSD  Liquid Staked ETH

Liquid Staked ETH  Lombard Staked BTC

Lombard Staked BTC  Renzo Restaked ETH

Renzo Restaked ETH  Polygon Bridged USDT (Polygon)

Polygon Bridged USDT (Polygon)  Optimism

Optimism  Celestia

Celestia  Jupiter Staked SOL

Jupiter Staked SOL  Injective

Injective  Tether Gold

Tether Gold  PayPal USD

PayPal USD  Mantle Staked Ether

Mantle Staked Ether  Immutable

Immutable  SPX6900

SPX6900  NEXO

NEXO  Wrapped BNB

Wrapped BNB  Stacks

Stacks  Sonic

Sonic  Solv Protocol BTC

Solv Protocol BTC  Curve DAO

Curve DAO  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  syrupUSDC

syrupUSDC  Aerodrome Finance

Aerodrome Finance  PAX Gold

PAX Gold  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Super OETH

Super OETH  The Graph

The Graph  FLOKI

FLOKI  Pyth Network

Pyth Network  Saros

Saros  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  dogwifhat

dogwifhat  Raydium

Raydium  Kaia

Kaia  Conflux

Conflux  Fartcoin

Fartcoin  Four

Four  cgETH Hashkey Cloud

cgETH Hashkey Cloud  clBTC

clBTC  PancakeSwap

PancakeSwap  Zcash

Zcash  Virtuals Protocol

Virtuals Protocol  Theta Network

Theta Network  Pendle

Pendle  Tezos

Tezos  GALA

GALA  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ethereum Name Service

Ethereum Name Service  IOTA

IOTA  The Sandbox

The Sandbox  Jito

Jito  Binance-Peg Dogecoin

Binance-Peg Dogecoin  JasmyCoin

JasmyCoin  Ripple USD

Ripple USD  Aethir

Aethir  OUSG

OUSG  Ether.fi

Ether.fi  Stader ETHx

Stader ETHx  Flow

Flow  Decentraland

Decentraland  tBTC

tBTC  Stables Labs USDX

Stables Labs USDX  Ondo US Dollar Yield

Ondo US Dollar Yield  ether.fi Staked ETH

ether.fi Staked ETH  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BitTorrent

BitTorrent  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  AB

AB  Mantle Restaked ETH

Mantle Restaked ETH  Walrus

Walrus  Swell Ethereum

Swell Ethereum  Beldex

Beldex  Global Dollar

Global Dollar  Loaded Lions

Loaded Lions  Usual USD

Usual USD  BUILDon

BUILDon  Starknet

Starknet  Vision

Vision  Brett

Brett  EigenCloud (prev. EigenLayer)

EigenCloud (prev. EigenLayer)  Bitcoin SV

Bitcoin SV  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Maple Finance

Maple Finance  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX  Bybit Staked SOL

Bybit Staked SOL  dYdX

dYdX  Helium

Helium  Polygon PoS Bridged WETH (Polygon POS)

Polygon PoS Bridged WETH (Polygon POS)  ApeCoin

ApeCoin  TrueUSD

TrueUSD  USDD

USDD  Arweave

Arweave  NEO

NEO  Telcoin

Telcoin  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  Linea

Linea  Fluid

Fluid  Reserve Rights

Reserve Rights  Core

Core  THORChain

THORChain  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Keeta

Keeta