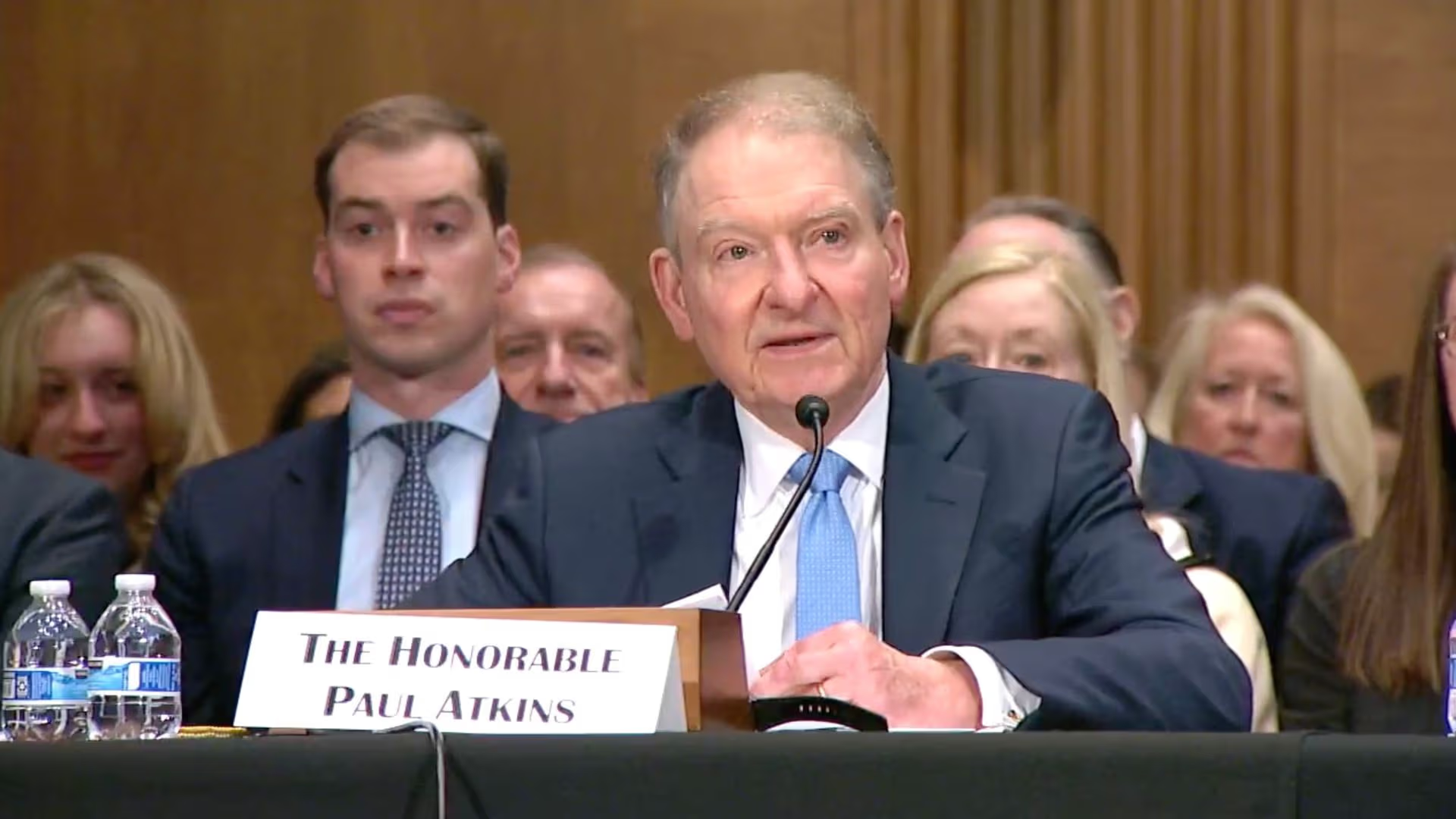

The U.S. Securities and Exchange Commission (SEC) is preparing to advance new regulatory measures in 2025 aimed at fostering innovation among cryptocurrency firms, according to Commissioner Paul Atkins.

Atkins, speaking at an industry forum, emphasized that the agency is actively working toward a framework that balances investor protection with the need to encourage growth in digital asset markets. He noted that outdated regulatory hurdles have slowed progress in the sector and that the upcoming rules will be designed to provide greater clarity for businesses seeking to operate within the U.S.

“Regulatory certainty is essential if we want to see responsible innovation flourish,” Atkins said. “Our goal is to modernize the rules in a way that safeguards investors without stifling technological advances.”

The initiative reflects the SEC’s broader shift toward accommodating the rapid expansion of blockchain-based financial services and digital assets. Market participants have long called for clearer guidance on issues such as token classification, custody standards, and secondary market trading.

Industry leaders welcomed Atkins’ remarks, interpreting them as a sign that Washington is becoming more open to the role of crypto in mainstream finance. However, some observers cautioned that the final shape of the regulations will depend on negotiations within the Commission and with other U.S. regulators.

If implemented, the 2025 rule changes could mark a pivotal moment for the U.S. digital asset ecosystem, potentially reducing regulatory uncertainty and opening the door for more institutional participation in the sector.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Cardano

Cardano  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Zcash

Zcash  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Stellar

Stellar  WETH

WETH  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Monero

Monero  Hedera

Hedera  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Uniswap

Uniswap  Polkadot

Polkadot  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  MemeCore

MemeCore  Mantle

Mantle  PayPal USD

PayPal USD  Canton

Canton  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  USD1

USD1  Internet Computer

Internet Computer  Aave

Aave  Aster

Aster  Currency One USD

Currency One USD  Bitget Token

Bitget Token  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Falcon USD

Falcon USD  Aptos

Aptos  Pi Network

Pi Network  Tether Gold

Tether Gold  Pepe

Pepe  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Pump.fun

Pump.fun  Solana

Solana  Binance-Peg WETH

Binance-Peg WETH  Ondo

Ondo  HTX DAO

HTX DAO  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Official Trump

Official Trump  Filecoin

Filecoin  PAX Gold

PAX Gold  Algorand

Algorand  USDtb

USDtb  Arbitrum

Arbitrum  BFUSD

BFUSD  Rocket Pool ETH

Rocket Pool ETH  syrupUSDC

syrupUSDC  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Binance Staked SOL

Binance Staked SOL  Gate

Gate  VeChain

VeChain  Wrapped BNB

Wrapped BNB  Circle USYC

Circle USYC  Starknet

Starknet  syrupUSDT

syrupUSDT  Global Dollar

Global Dollar  Sky

Sky  Ripple USD

Ripple USD  Function FBTC

Function FBTC  Render

Render  Lombard Staked BTC

Lombard Staked BTC  Liquid Staked ETH

Liquid Staked ETH  Dash

Dash  Solv Protocol BTC

Solv Protocol BTC  Sei

Sei  NEXO

NEXO  Story

Story  Renzo Restaked ETH

Renzo Restaked ETH  Jupiter

Jupiter  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Bonk

Bonk  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Rain

Rain  Pudgy Penguins

Pudgy Penguins  OUSG

OUSG  PancakeSwap

PancakeSwap  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Mantle Staked Ether

Mantle Staked Ether  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Virtuals Protocol

Virtuals Protocol  Optimism

Optimism  Aerodrome Finance

Aerodrome Finance  clBTC

clBTC  Ondo US Dollar Yield

Ondo US Dollar Yield  Jupiter Staked SOL

Jupiter Staked SOL  Injective

Injective  Lido DAO

Lido DAO  Celestia

Celestia  Curve DAO

Curve DAO  Stacks

Stacks  Beldex

Beldex  StakeWise Staked ETH

StakeWise Staked ETH  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Telcoin

Telcoin  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  The Graph

The Graph  Marinade Staked SOL

Marinade Staked SOL  tBTC

tBTC  Tezos

Tezos  AB

AB  USDai

USDai  Ether.fi

Ether.fi  Usual USD

Usual USD  SPX6900

SPX6900  MYX Finance

MYX Finance  Decred

Decred  IOTA

IOTA  Mantle Bridged USDT (Mantle)

Mantle Bridged USDT (Mantle)  FLOKI

FLOKI  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  TrueUSD

TrueUSD  cgETH Hashkey Cloud

cgETH Hashkey Cloud  Kaia

Kaia  Trust Wallet

Trust Wallet  Ethereum Name Service

Ethereum Name Service  GTETH

GTETH  Stader ETHx

Stader ETHx  The Sandbox

The Sandbox  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Plasma

Plasma  Conflux

Conflux  Sonic

Sonic  GHO

GHO  DoubleZero

DoubleZero  USDD

USDD  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Flow

Flow  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Bitcoin SV

Bitcoin SV  Wrapped HYPE

Wrapped HYPE  ether.fi Staked ETH

ether.fi Staked ETH  Sun Token

Sun Token  BitTorrent

BitTorrent  Maple Finance

Maple Finance  dogwifhat

dogwifhat  sBTC

sBTC  Binance-Peg Dogecoin

Binance-Peg Dogecoin  Swell Ethereum

Swell Ethereum  Theta Network

Theta Network  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Pendle

Pendle  GALA

GALA  JasmyCoin

JasmyCoin  Helium

Helium  Merlin Chain

Merlin Chain  AINFT

AINFT  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  JUST

JUST  ZKsync

ZKsync  Ape and Pepe

Ape and Pepe  BENQI Liquid Staked AVAX

BENQI Liquid Staked AVAX